The 2024 Federal Budget was handed down last night. Here’s a quick overview of what the proposed measures and packages will mean for you.

Cost of living measures

Energy bill relief

Every Australian household will receive a $300 energy bill rebate to help offset ever-increasing costs of living.

Revamp of stage-three income tax cuts

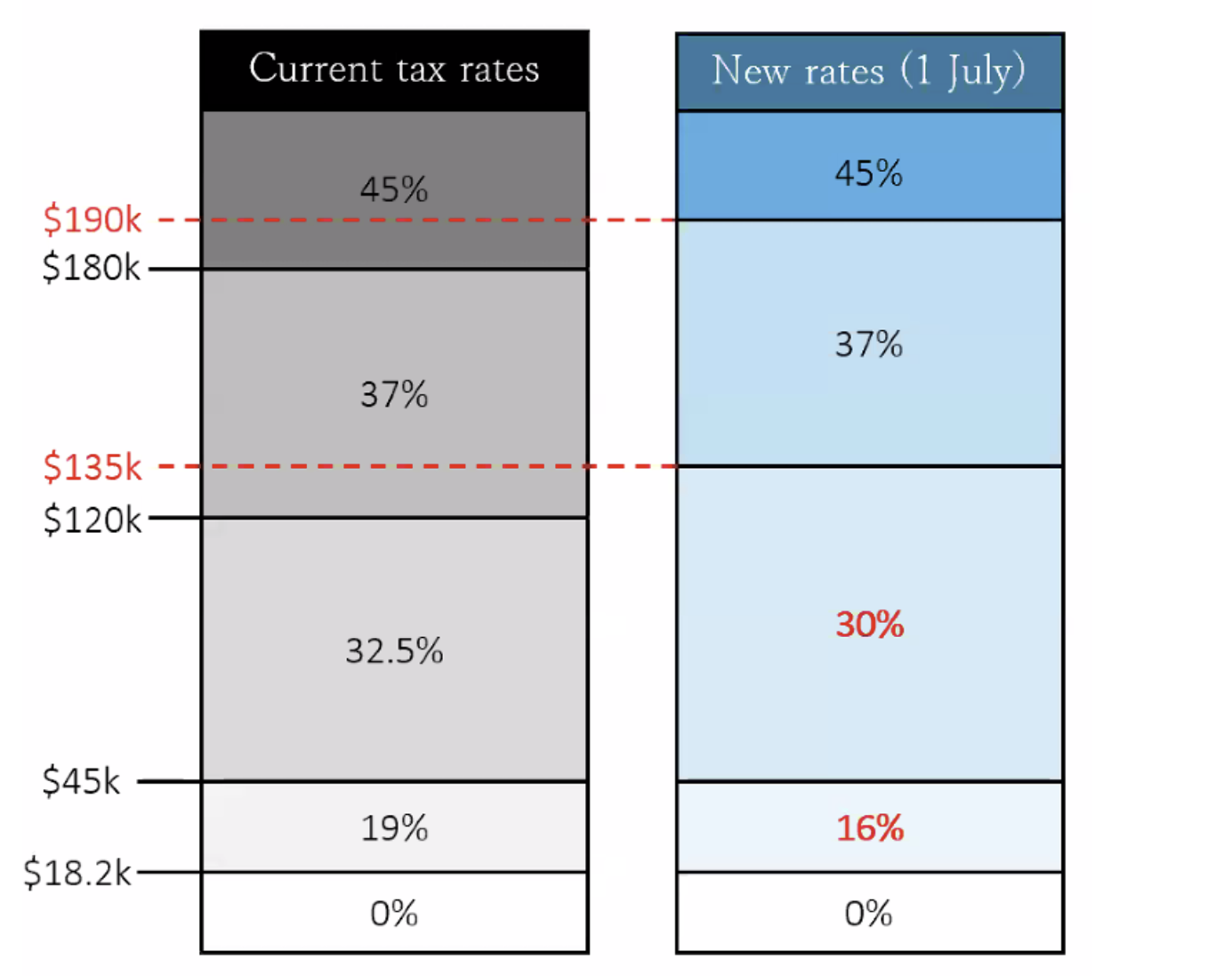

From 1 July 2024, the personal income tax rates and thresholds will change as follows:

In summary:

- The 19% tax rate will reduce to 16%

- The 32.5% tax rate reduces to 30%

- The income threshold above which the 37% tax rate applies increases from $120,000 to $135,000

- The income threshold above which the 45% tax rate applies increases from $180,000 to $190,000.

The government has also announced increases to the Medicare levy low-income thresholds:

- The threshold for singles has been increased from $24,276 to $26,000

- The family threshold has been increased from $40,939 to $43,846

- The family income thresholds will now increase by $4,027 for each dependent child, up from $3,760

- The threshold for single seniors and pensioners has been increased from $38,365 to $41,089

- The family threshold for seniors and pensioners has been increased from $53,406 to $57,198.

How will the tax cuts benefit you? This income tax calculator can give you an indication.

Increase in rent assistance

The government will boost its Commonwealth Rent Assistance program to assist Australians on the lowest incomes.

As part of changes that will take effect from September, just under one million Australian renters will enjoy a 10% increase on the maximum rate of rent assistance available to them under the Commonwealth Rent Assistance program. This follows a 15% increase in last year’s budget.

PBS

For Medicare cardholders with a prescription, the cost of medicines on the Pharmaceutical Benefits Scheme (PBS) will be frozen for a year.

For pensioners and concession cardholders, the co-payment cost of PBS medicines will be frozen for five years.

Students

As has been well-publicised, the government is capping the indexation of student loans at either the consumer price index or the wage price index, whichever is lower.

This will be backdated to mid-2023, addressing the 7.1% indexation hike that happened at that time, the highest ever seen before.

For the average student with a debt of $26,500, this measure will cut around $1,200 from their outstanding HECS-HELP debt this year.

Small businesses

Energy bill relief

Roughly one million small businesses will be eligible to receive a $325 rebate on their electricity costs.

Extension to instant asset write-off scheme

The instant asset write-off scheme has been extended again. Businesses with an aggregated annual turnover of less than $10m will continue to be able to immediately deduct the full cost of eligible assets under $20,000, provided they’re first used or installed and ready by the end of June 2025. The scheme can be used on multiple assets.

Women

Super on government-funded paid parental leave

The government will spend $1.1bn over four years to pay superannuation on government-funded paid parental leave from July 2025. This is to address the 25% disparity in retirement incomes between men and women.

Women’s health initiatives

$56m has been pledged for several women’s health initiatives, including:

- $12.5m over four years for the National Aboriginal Community Controlled Health organisation to provide free period products

- $7m over four years to support women and families who have suffered miscarriage

- $5.2m over three years to train health workers to insert and remove long-acting reversible contraceptives, as well as training for GPs to better treat menopause.

Women will also benefit from higher rebates for longer consultations for patients with complex gynaecological conditions such as endometriosis. (The government will spend $49.1m to subsidise this.)

Gender audit of Medicare-funded services

This includes addressing things like the fact the current rebate on ultrasounds of the scrotum is significantly higher than for a female pelvic ultrasound. Measures will also be introduced to improve access to affordable abortion services by easing rules around ultrasounds.

Domestic violence

The government has announced a program to help women leave domestic violence situations, with payments of up to $5,000 and access to other support services at a cost of $756.4m over five years. A significant portion of existing social housing spending has also been redirected to crisis and transitional accommodation for women and children fleeing domestic violence.

Older Australians

Aged care

The Government will provide $2.2 billion over five years from 2023–24 to deliver key aged care reforms and to continue to implement recommendations from the Royal Commission into Aged Care Quality and Safety. Funding includes:

- $1.2 billion over five years for sustaining and enhancing critical aged care digital systems

- $531 million to release 24,100 additional home care packages in 2024–25

- $111 million over four years from 2024–25 to increase the regulatory capability of the Aged Care Quality and Safety Commission

- $66 million over four years from 2024–25 to attract and retain aged care workers, collect more reliable data, and improve the outcomes for people receiving aged care services through existing aged care workforce programs

- $37 million over two years from 2024–25 to reduce wait times for the My Aged Care Contact Centre

- $30 million over three years from 2024–25 to states and territories to continue to deliver the Specialist Dementia Care Program

- $22 million over three years from 2024–25 to extend the Home Care Workforce Support Program for an additional three years to facilitate the growth of the care and support workforce in thin markets.

The Government has also agreed to defer the commencement date of the new Aged Care Act to 1 July 2025.

Deeming rates frozen for 12 months

The Government is continuing the freeze on social security deeming rates for financial investments at their current levels for another 12 months. The lower deeming rate will remain at 0.25%, and the upper rate will remain at 2.25% until 30 June 2025. This will benefit around 876,000 income support recipients, including around 450,000 aged pensioners.

Families

Superannuation on Government-funded paid parental leave

The Government has confirmed its pre-budget announcement that for births and adoptions on or after 1 July 2025, it will pay superannuation on the government-funded paid parental leave. This will be administered by the ATO.

It will benefit 180,000 families a year and reduce the gender super gap, (which currently sees women retire with around 25% less super than men). Paying an annual superannuation payment of 12% on the full partnered entitlement of 22 weeks will increase a median earning mother’s superannuation balance at retirement by around $4,250, or 1.15%.