In the past, the transition to retirement has been viewed solely as an economic event. As a result, the focus of retirement planning has primarily been on building a nest egg.

In The Late-Start Investor, author John Wasik recommends discarding this obsolete view in favour of a “flexible life plan that provides for financial, vocational, physical, emotional, and spiritual needs.” He explains, “Unless you look at your future holistically, merely saving up a pile of money will be a meaningless act.”

In other words, financial security is extremely important, but financial resources alone will not guarantee a rich and rewarding life in retirement.

Thomas J. Stanley, author of The Millionaire Mind, points out that the most satisfied wealthy people don’t just have financial goals, they also have life goals. And, because they have clarity around what they want in life, they use their wealth as a tool to support those values and priorities.

Therefore, the most important retirement planning message for adults of all ages is “it takes more than money.” With this in mind, make sure that you not only consider how the transition to retirement will affect your life financially, but how it will influence all other areas of your life as well.

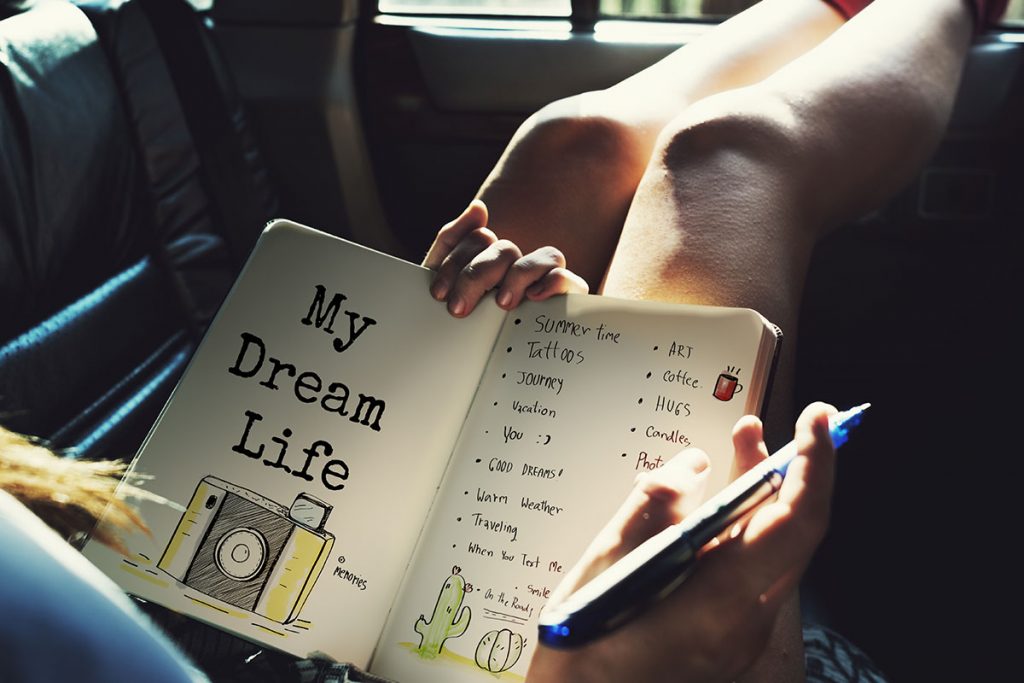

The first step to preparing for your retirement years is to think about and clarify what is most important to you. This is a time to listen to your own heart and to focus on what you value most in life. Whatever you identify will become the foundation for your life goals.

The next step is to think about the role that money can play in helping you to achieve each life goal:

- Will having sufficient financial resources give you more options for realizing your life goals?

- Will economic security give you more freedom to focus your time and attention on what is most important to you?

- Will financial independence allow you to pursue those activities that will give your life a sense of meaning and purpose?

Answering these questions will help you to understand how your money is integrated into all areas of your life, not as an end in itself, but as an instrument for creating the life you want—now and in retirement.

As the premier financial planners in Perth, we believe that there is a lot of truth to the old saying, “Money can’t buy happiness.” However, your wealth will give you more opportunities to invest your time and energy in ways that matter most to you.

Contact us at HPH Solutions, the most trusted financial advisors in Perth, West Australia.

—

Reprinted by permission of Money Quotient, NP