More than two years into the steepest interest-rate tightening cycle in decades, central banks worldwide are grappling with how fast to unwind the policy and start to bring interest rates down. Australia and the US remain in a holding pattern, with the RBA now contemplating one more rate increase. Stock markets are in a period of uncertainty as they accept that taming inflation is not going to be easy.

At the start of this year, it is fair to say that stock markets were in a state of euphoria as central banks around the world indicated that they had finished with their interest rate tightening cycle and the next moves in rates would be down. In Australia, some commentators predicted that the RBA would start cutting by June, with at least two rate cuts forecast for this year. The US market was even more excited, predicting that rates would come down by 0.75% by the end of this year.

However, price pressures have proved stubborn. A strong US dollar has hampered developing nations, and geopolitical tensions have added a layer of uncertainty to the post-pandemic economic recovery. In Australia, the consumer price indicator rose to 3.6% in April – its highest level so far this year – overshooting expectations for inflation to cool to 3.4% and well above the RBA’s 2% to 3% target.

The higher-than-expected inflation now has economists considering the possibility that the RBA may need to lift rates further to pull inflation down to target. Money markets have modestly raised the probability that the Reserve Bank will lift the cash rate by a further 0.25% to 4.6%. While the monthly consumer price index is volatile, the figures highlighted the persistence of Australia’s inflation outbreak, with underlying inflation stuck close to 4%.

The latest unemployment data in the US shows that the US jobs market remains buoyant, while the recent purchasing managers indices pointed to a fresh acceleration in US growth. Sharemarket investors are becoming increasingly anxious about the jump in US bond yields as expectations of US interest rate cuts are pushed back again.

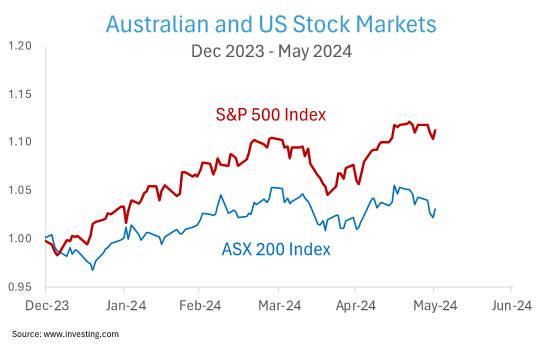

The chart below shows the daily performance of the Australian and US stock markets since the start of 2024. But after that strong start to 2024, equity markets now face magnified risks amidst signs of resurgent inflation and weaker economic data. Markets have been trading flat since the end of the first quarter – the ASX 200 Index is down 2%, while the main US index is up 2%.

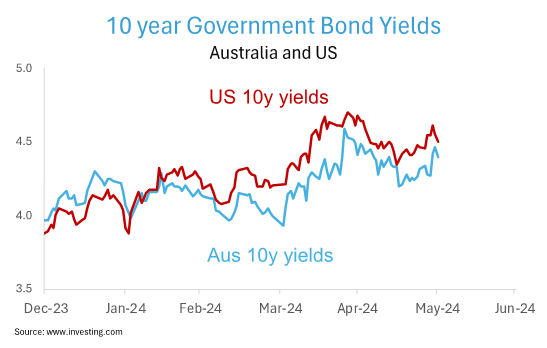

Bond markets have been pricing in the continued elevated inflation data, and longer bond yields have been rising over the course of this year. However, the chart below shows that the bond market is balancing the dual roles of pricing in higher for longer interest rates while also countering weaker equity markets with a drop in yields over April.

These two charts show that risk appetite has weakened, and the ongoing reassessment of the timing of rate cuts in Australia and the US continues to weigh on markets. Futures markets are now pricing in the expectation that the US Federal Reserve will make only one 25 basis point rate cut this year from its present target range of 5.25% to 5.5%. In Australia – notwithstanding the heightened risk of an interest rate rise – economists have pushed back the timing for the RBA’s first interest rate cut until sometime in 2025.

What does all this mean for Australian investors in a balanced portfolio? One doesn’t need an economist to tell us that the economy is slowing. While unemployment remains robust, the data still points to a low GDP growth rate for the coming quarters. Prices remain elevated, and businesses and individuals are feeling the pressures of the higher cost of living. However, over a longer horizon, inflation is receding – although the economy is not slowing as quickly as the RBA would like – so rates will continue to remain higher for longer.

The economy and the stock market are not the same thing, however. As the charts above illustrate, the markets price in new economic data instantaneously and make forward expectations on where prices will be in the future. While the equity markets are in a state of flux and risk appetites have weakened, it is important to realize that markets are positive on a year-to-date basis.

While higher 10-year yields are not great for bond investors in the short term, the post-pandemic inflation shock and the rate-hiking cycle have produced a reset in higher bond yields, creating a convincing multiyear outlook for fixed interest as inflation recedes. Furthermore, as we have seen, bonds have returned to their usual place as safe-haven assets and are well-positioned to protect a balanced portfolio in times of risk aversion.

Rates are likely to stay higher for some time, and even though the economy may fatigue as central banks continue to try and tame the inflation dragon, it does not follow that the stock market will necessarily retreat. The best course of action for investors is to ignore the constant news cycle that reports on every bit of new economic data as if it somehow determines the future of their portfolio. Tune out the financial media noise and stay disciplined in a well-diversified portfolio that has been created to meet your needs.