The recent Federal Budget in Australia and the upcoming equivalent annual fiscal statement in New Zealand always generate significant media coverage and can raise questions among investors about the implications for asset prices arising from the governments’ projections for revenue, spending, public debt and major economic variables like inflation and growth.

While not as significant in absolute or proportional terms as major economies like the US, the UK, France or Japan, public debt in Australia and New Zealand is still sizeable, at around 38.6% and 52.8% of gross domestic product respectively.1

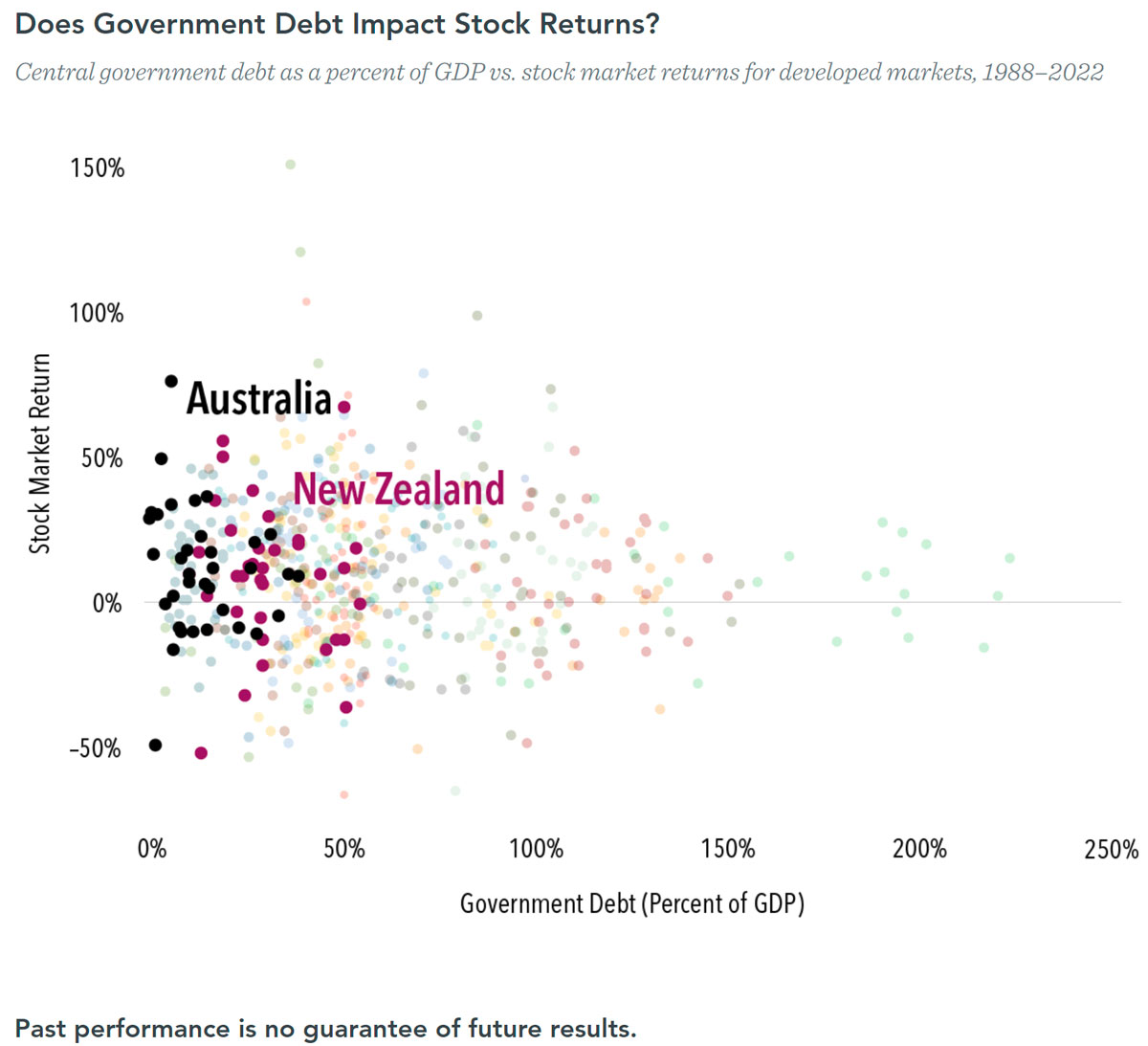

Yet, we can see in the chart below that there has been little relationship between central government debt and stock market returns over the past few decades. In fact, this lack of a link holds true even for the nations with much higher levels of public debt such as the US, whose equity market has been one of the world’s best performing in recent years.

How can this be? Firstly, the call of governments on capital markets is public information and is already reflected in the prices of both stocks and bonds. These prices are set to the point where investors have a positive expected return given current information.

Secondly, country debt is a slow-moving variable, so it’s sensible that current prices reflect expectations about the effect of government debt.

Thirdly, public debt is but one of a myriad of variables that can affect security prices. These also include company earnings, technological innovation, inflation and the level of interest rates, consumer demand, sectoral trends, and mergers and acquisitions.

This isn’t to say that governments are not significant players in capital markets or that their spending and revenue decisions do not warrant attention. But investors are better off sticking to a sound investment plan designed to achieve long-term goals than trying to second-guess what trends in public debt will mean for their portfolios.

—

The information in this material is intended for the recipient’s background information and use only. It is provided in good faith and without any warranty or representation as to accuracy or completeness. Information and opinions presented in this material have been obtained or derived from sources believed by Dimensional to be reliable, and Dimensional has reasonable grounds to believe that all factual information herein is true as at the date of this material. It does not constitute investment advice, a recommendation, or an offer of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. Before acting on any information in this document, you should consider whether it is appropriate for your particular circumstances and, if appropriate, seek professional advice. It is the responsibility of any persons wishing to make a purchase to inform themselves of and observe all applicable laws and regulations. Unauthorized reproduction or transmission of this material is strictly prohibited. Dimensional accepts no responsibility for loss arising from the use of the information contained herein.

This material is not directed at any person in any jurisdiction where the availability of this material is prohibited or would subject Dimensional or its products or services to any registration, licensing, or other such legal requirements within the jurisdiction.

“Dimensional” refers to the Dimensional separate but affiliated entities generally, rather than to one particular entity. These entities are Dimensional Fund Advisors LP, Dimensional Fund Advisors Ltd., Dimensional Ireland Limited, DFA Australia Limited, Dimensional Fund Advisors Canada ULC, Dimensional Fund Advisors Pte. Ltd., Dimensional Japan Ltd., and Dimensional Hong Kong Limited. Dimensional Hong Kong Limited is licensed by the Securities and Futures Commission to conduct Type 1 (dealing in securities) regulated activities only and does not provide asset management services.

RISKS

Investments involve risks. The investment return and principal value of an investment may fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original value. Past performance is not a guarantee of future results. There is no guarantee strategies will be successful.

AUSTRALIA

This material is issued by DFA Australia Limited (AFS License No. 238093, ABN 46 065 937 671). This material is provided for information only. No account has been taken of the objectives, financial situation or needs of any particular person. Accordingly, to the extent this material constitutes general financial product advice, investors should, before acting on the advice, consider the appropriateness of the advice, having regard to the investor’s objectives, financial situation and needs. Investors should also consider the Product Disclosure Statement (PDS) and the target market determination (TMD) that have been made for each financial product either issued or distributed by DFA Australia Limited prior to acquiring or continuing to hold any investment. Go to dimensional.com/funds to access a copy of the PDS or the relevant TMD. Any opinions expressed in this material reflect our judgement at the date of publication and are subject to change.