Since January 1, 2020, the world has faced an extraordinary series of economic and geopolitical challenges that have tested global resilience. The COVID-19 pandemic was the first major disruption, leading to the grounding of airlines, the halting of international travel, and the unprecedented shutting of sovereign borders. The resulting economic slowdown sent shockwaves through markets as businesses closed, supply chains stalled, and governments scrambled to implement massive stimulus measures.

As the world began to recover, a surge in global inflation emerged, driven by supply chain bottlenecks and unprecedented fiscal and monetary stimulus. Energy prices also spiked, with oil becoming a significant flashpoint as global demand resurged post-lockdown. This was compounded by Russia’s invasion of Ukraine in early 2022, which disrupted energy and agricultural markets, leading to volatility and concerns about food and energy security. More recently, the world has witnessed another conflict in the Middle East, further exacerbating geopolitical tensions and casting uncertainty over global markets.

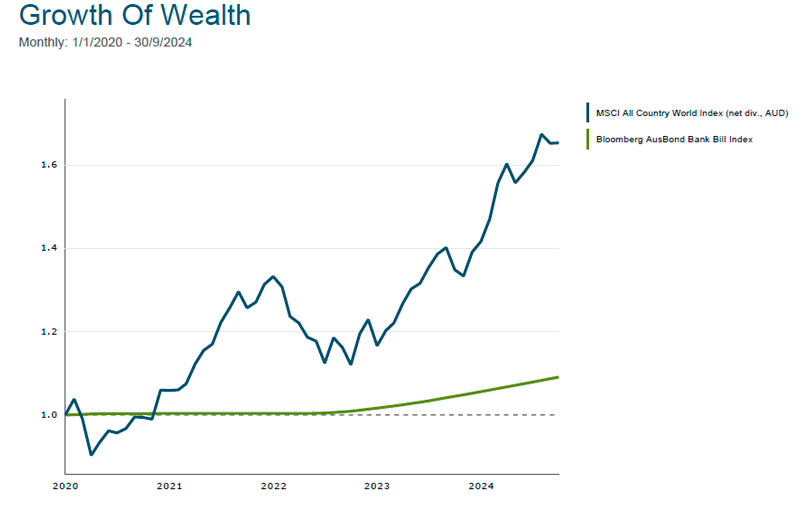

Despite the gravity of these events, the image below tells a story of resilience and opportunity within global share markets. From January 2020 to September 2024, the MSCI All Country World Index has delivered a significant return, climbing to over 1.6 times its initial value. This strong performance stands in sharp contrast to the bleak headlines of the past few years. It highlights the capacity of global equity markets to weather storms and capitalise on long-term growth drivers, even amid widespread turmoil.

Investors who maintained discipline and a long-term perspective have been rewarded during this tumultuous period. The consistent upward trajectory of the Bloomberg AusBond Bank Bill Index underscores the role of lower-risk assets, but it pales compared to the returns achieved by global equities.

This divergence between global crises and market performance serves as a reminder of the power of diversification and the importance of staying invested, even when the outlook appears dire. While the world has undoubtedly faced immense challenges, the resilience and adaptability of financial markets offer a source of optimism and opportunity for long-term investors.