What is Financial Advice for Life?

Financial Advice for Life is a values-based approach to financial planning. It is a holistic and ongoing process that focuses on both the practical and personal factors that either enhance or hinder quality of life and financial satisfaction.

If you’re thinking this perspective is unique, you would be right. Rather than using net worth as the true picture of one’s financial status, we take a more holistic approach to assessing ‘true wealth’.

HOW FINANCIAL ADVICE FOR LIFE WORKS

Our Perth-based financial planning professionals start by clarifying your values, priorities and aspirations.

We then create financial strategies tailored to your specific situation and provide advice that will help you reach your objectives.

Finally, we follow up regularly with you to ensure that the financial strategies created for you keep up with your lifestyle aspirations as they evolve.

WHY YOU NEED FINANCIAL ADVICE FOR LIFE

It’s not easy keeping up with ever-changing financial regulations and markets to ensure your financial life plan is optimised for your needs. Working with a qualified and professional financial planner takes away the stress, time investment and self-doubt that comes from having to figure everything out yourself.

While the sheer act of having a plan gives you a sense of control, working with a financial life planning advisor will give you confidence in your plan. And it’s that confidence that will allow you to sleep well at night.

At HPH Solutions, our experienced financial planners put your interests first and focus on enhancing your sense of financial wellbeing and satisfaction.

With offices in Como, Mandurah and Geraldton, we provide a suite of financial services and advice. Centred on assisting with money management and planning at every level, our award-winning team will help you reach your goals and feel more fulfilled and secure.

Find out how we’ve helped other clients just like you.

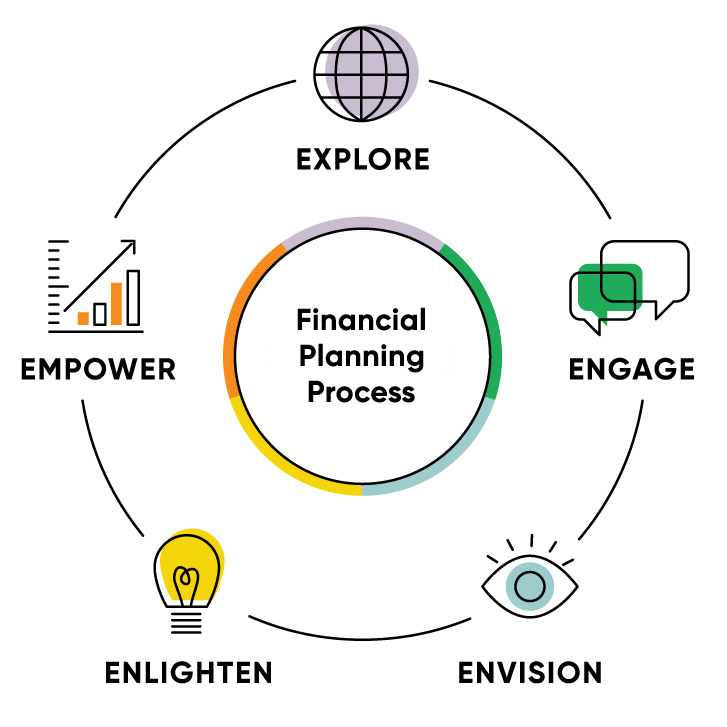

OUR FINANCIAL PLANNING PROCESS

Our financial planning process is a holistic one that:

- Focuses on increasing your sense of financial well-being and life satisfaction

- Helps you clarify your values, priorities, circumstances, and aspirations

- Guides you in defining and designing your personal vision of a fulfilling life.

We work through a series of five steps with you to create a sound financial life plan that will give you freedom from worry, give you back your personal time and ensure you and your loved ones are always well taken care of.

In this stage, your adviser’s main objective is to gather enough personal and financial information to:

- Understand your main issues and concerns,

- Estimate the scope of the engagement, and

- Verify that the relationship will be a good fit for both parties.

Supported by life-centred exercises and conversation, the important outcome of this stage is that your adviser understands your values and priorities to shape your financial plan.

In this stage, your adviser will summarise and clarify his/her new insights and knowledge about your values, priorities, concerns, transitions, goals and objectives.

The purpose of this stage is to verify understanding of what you have communicated and to reinforce our commitment to put your interests first.

When presenting your financial plan, your adviser will then explain how the financial solutions being proposed, support the life vision and goals you have created.

This stage begins when a commitment has been made – by both your adviser and yourself – to move forward with a working relationship.

Through an in-depth data gathering process, one of the goals in this stage is to understand where you are now in several areas of life as well as the journey that brought you to this point in time.

This insight will help your adviser to understand your unique perspective on a range of life and money issues.

The objective of this fourth stage is to assist you in creating a vision for your future that is compelling, fulfilling, and inspiring.

This mental picture will include everything that is important to you and contributes to your happiness and life satisfaction. The next step is to mutually define personal and financial goals that align with and support that image.

For your adviser, the visualisation and goal setting process will establish clear guidelines for creating a financial plan that is aligned with your values and priorities.

Armed with new insight and knowledge, you will be empowered to take action because of the direct link between the financial advice delivered and your unique perspective of “quality of life”.

Your adviser will continue to act as a guide in this stage, monitoring progress and helping to maintain focus on your personal and financial goals.

Because unanticipated events occur and priorities shift over time, it is important for you and your adviser to regularly review your financial plan to make sure it remains relevant to your life journey.

Learn more about financial life planning with HPH Solutions. Contact us on (08) 9200 3123.

FINANCIAL PLANNING ARTICLES YOU MIGHT LIKE

5 key things to know about 2025 Aged Care rule changes

New aged care rules will take effect from 1 July 2025 that may add complexity in understanding aged care fees and making informed financial decisions.

The Trusted Adviser Episode 16: Building enduring advice practices with Warr Hunt

In this episode of The Trusted Adviser, Rob Pyne is joined by Anthony Warr and Bianca Musico from Warr Hunt — a firm renowned for its leadership in mentoring, team […]

The Trusted Adviser Episode 15: Unlocking private insights with Frontier Advisors

n this episode of The Trusted Adviser Podcast, host Rob Pyne is joined by James Damicoucas and Tom Bernard from Frontier Advisers