Every major currency in the world has fallen against the US dollar this year, an unusually broad shift with consequences across the global economy. The strength of the greenback stems from a shift in expectations about when and by how much the Federal Reserve may cut its benchmark interest rate, which is at a 20-year high. A strong US dollar has negative and positive effects, and how they play out will have a lot to do with the stickiness of high inflation.

High US interest rates, a response to stubborn inflation, have seen an unusually high US dollar against other major currencies. The dollar index, a common way to gauge the general strength of the US currency against a basket of its major trading partners, is hovering at levels last seen in the early 2000s (when US interest rates were also similarly high).

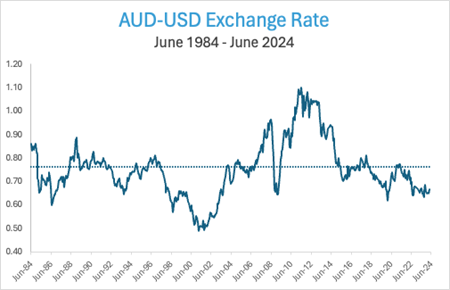

For example, the yen is at a 34-year low against the US dollar, and the euro and Canadian dollar are sagging. The Chinese yuan has shown notable signs of weakness despite officials’ stated intent to stabilize it. And the Australian dollar has been trading around 66 cents—below its 40-year average of 75 cents—for the last two years.

The dollar is on one side of nearly 90 percent of all foreign exchange transactions. A strengthening US currency intensifies inflation abroad, as countries need to swap more of their own currencies for the same amount of dollar-denominated goods, including imports from the United States and globally traded commodities, like oil, often priced in dollars. Countries that have borrowed in dollars also face higher interest bills.

However, there can also be benefits for some foreign businesses. A strong dollar benefits foreign exporters that sell to the United States, as Americans can afford to buy more foreign goods and services. In particular, travel to other countries becomes cheaper and more accessible for Americans, benefitting holiday destinations worldwide.

There are pros and cons to a strong US dollar for US-based business as well. On the one hand, a strong dollar can dent the earnings of the big US multinationals that dominate the S&P 500. Analysts estimate that about 40 percent of the revenue generated by S&P 500 companies comes from outside the United States. When these foreign currencies weaken against the greenback, this depresses revenues and profits when translated into US dollars. The effect is particularly noticeable for firms that are heavily reliant on foreign sales, such as the big US tech firms.

On the other hand, US manufacturers that purchase parts for their production lines from outside the States will likely pay less for these parts based on the strong dollar. As manufacturing costs go down, their profit margins will likely go up. While a strong US dollar weighs on the world, there are positive and negative consequences for both Americans and the rest of the world.

Why is the US dollar so strong?

The spiking inflation post-pandemic meant central banks had to aggressively raise interest rates to keep inflation under control. After more than two years into the steepest interest-rate tightening cycle in decades, the US now has one of the highest interest rates in the developed world, in the target range of 5.00%—5.25%.

By contrast, the Australian cash rate has been at a more modest 4.35% since November 2023. Interest rates play a significant role in the attractiveness of a country’s currency; high-interest rates lead to more foreign capital, which leads to an increase in exchange rates and consequently, a strong currency.

The chart below shows the 40-year history of the Australian dollar against the US dollar. While it is not presently at historic lows, the effect of the interest rate differential can be seen since June 2022. Historically, Australia has had higher rates than the US, but that has reversed in the battle to fight inflation.

Markets have been expecting US interest rates to start falling—and, therefore, the US currency to start weakening—since the end of last year. At that time, the Federal Reserve announced that there would be no further increases and that the following rate change would be downward. But prices have remained stubbornly high, which has meant that the Federal Reserve has needed to keep US rates higher for longer, which in turn has kept the US dollar stronger for longer.

Policymakers worldwide are now balancing the choice between supporting their domestic economies by cutting interest rates or supporting their currency by keeping them high. The longer they leave their interest rates high, the more their economy may suffer. It’s a tough choice.

An example of this risk is China, whose economy has been battered by a real estate crisis and sluggish domestic spending. The country, which seeks to hold its currency within a tight range, has recently relaxed its stance and allowed the yuan to weaken, demonstrating the pressure exerted by the dollar in financial markets and on other countries’ policy decisions.

It’s important to realise that while interest rate differentials play a significant role in setting the exchange rate, they are not the only factor. In Australia, for example, our dollar is influenced by other markets, particularly our largest trading partner, China, commodity prices, and other global factors.

Those who have been expecting the US to start cutting rates before Australia – thereby lowering the interest rate differential and strengthening the AUD – have been left stranded by stubborn inflation that has left rates both in the US and Australia on hold. While it seems to many commentators that the AUD must return to its “average” AUS/USD rate of 75 cents, there is no reason that this will actually happen, or if the AUD does start rising, when that will happen. There are many more factors in play than just the interest rate differential between the US and Australia.