When Australia ended the USA’s 132-year run in the America’s Cup yacht race in 1983, the secret weapon was deep underwater. An 18-tonne winged keel gave the yacht Australia II the stability – and the crew the confidence – to win the 7th and final race.

Providing similar ballast in a diversified portfolio is the fixed interest allocation. Like the winged keel on Australia II, bonds may not garner much of the attention, particularly in relation to the billowing sails of one’s equity allocation, but they are just as vital.

This remains true whether interest rates are at 10% or closer to zero, as has been the case in recent years. Equities provide the growth, but bonds provide the stability. Without them, it will be a very choppy voyage indeed.

Of course, that might not matter much earlier in a lifetime’s investing journey. In our 20s and 30s, our financial capital tends to be dwarfed by our human capital. We have decades to retirement and can afford to face the full brunt of the storm.

But as we age and there is more financial capital at risk, our portfolios may not have the time to recover from a 30% or 40% drawdown. That’s when the stability offered by the fixed income allocation – the winged keel of investment – becomes so important.

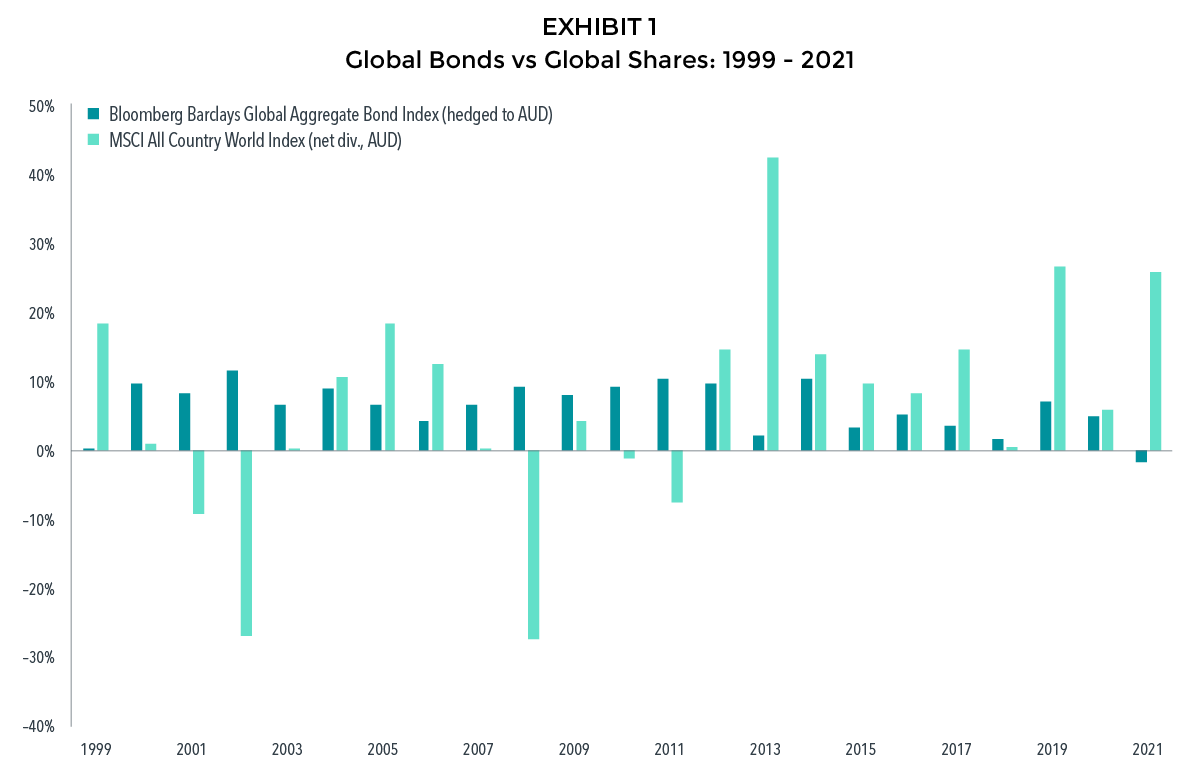

Exhibit 1 below shows the calendar year movements of the global share market, as represented by MSCI All Country World Index, against the movements of the global bond market, as represented by the Bloomberg Barclays Global Aggregate Bond Index.

You can see in the years in which the equity market experienced a decline – in 2002, 2008, 2010 and 2011 in this 22-year sample period – global bonds steadied the ship with positive performances and offering stability and confidence for investors.

This relationship, where bonds zig as shares zag is also seen in much longer periods, highlighting the role that bonds play in tempering the volatility of an overall portfolio.

While there are claims in the media that bonds no longer succeed in playing that stabilising role, we only have to go back to the first quarter of 2020 during the initial shock of the COVID-19 pandemic to see what a difference bonds made when equity markets sank 30-40% in five weeks.

Alongside their use as a volatility dampener, bonds can also be a source of liquidity, a protection against inflation and a source of returns.

As for zero or even negative interest rate environment, it is worth reflecting on the fact that the return on a bond is more than just its known income component. It is also made up of the expected capital gain for holding the bond for a set period based on the shape of today’s yield curve. This curve is the line drawn by bonds of the same credit quality but of different maturities.

Taking a global approach to bond investing allows for diversified portfolios that can more reliably deliver investment outcomes. And this is without having to try to forecast interest rates or spend a lot of time worrying what central banks will do.

In summary, bonds have an important part to play in a diversified portfolio:

- They behave differently to shares;

- Are less volatile; and

- Can offer stability during down markets for equities.

Bonds carry their own risks, but we can deal with those via diversification and discipline.