An upsurge in volatility in financial markets can test the nerve of many investors, particularly after a long period of relative calm. The big question is whether periods of volatility say anything about expected returns.

Of course, there are bound to be all manner of post-hoc explanations in the media about what caused this latest bout of volatility in markets and how all of this was totally predictable. (Oddly, these neat explanations tend to appear only after the fact.)

What we can say, however, is that volatility is a normal part of investing and that tidy cause-and-effect narratives don’t really tell us much that is useful about what comes next.

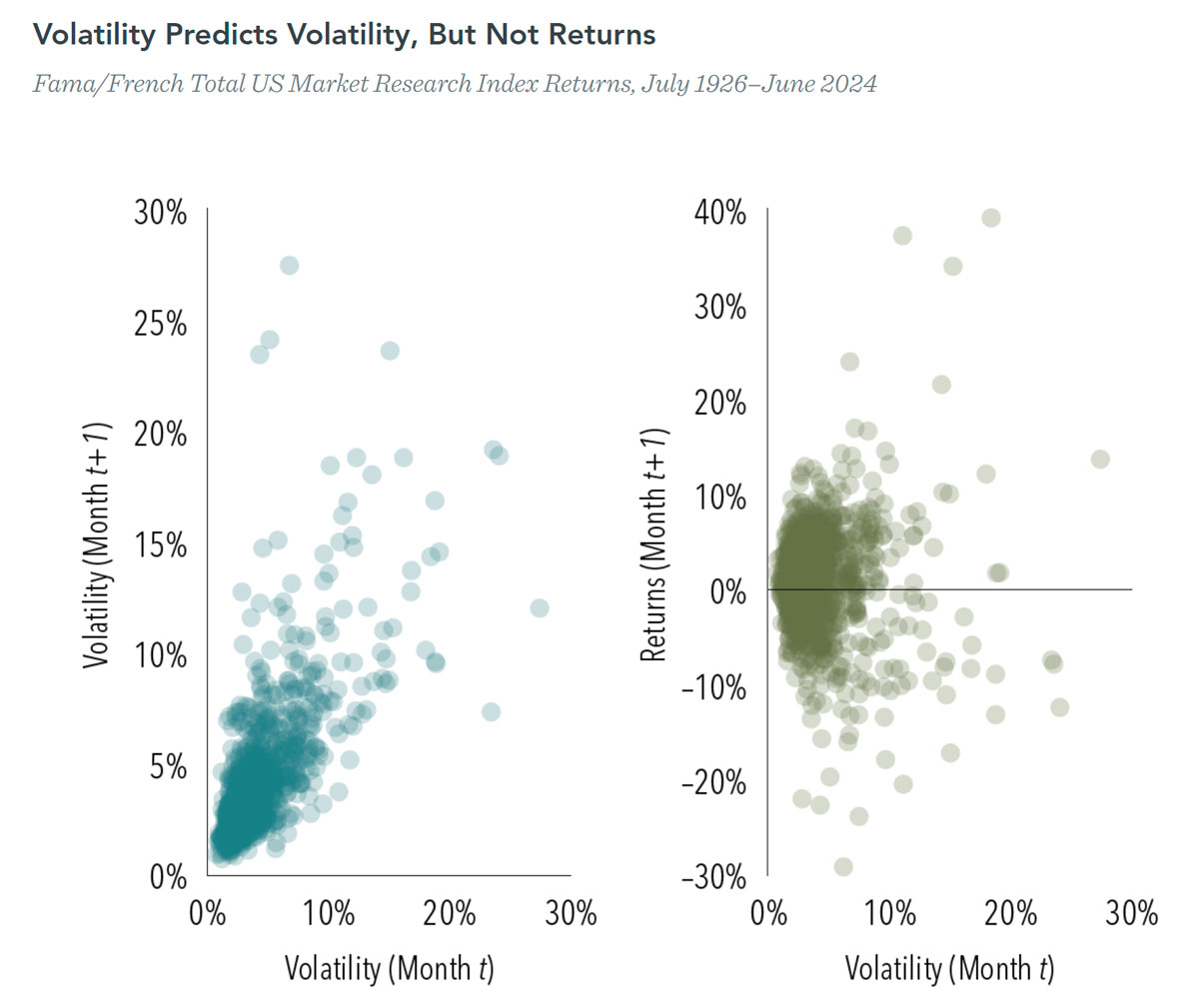

With that in mind, let’s examine whether market volatility says anything about future volatility, as well as whether it reliably predicts subsequent market performance. To do this, we can measure monthly US equity market volatility using the standard deviation of daily US market returns.

As you can see, we find no discernable pattern that suggests stock returns after rocky periods vary in a way that is attributable to the levels of volatility. In other words, high volatility doesn’t predict weak subsequent returns, and market returns have been positive after downturns. That makes sense as stock prices are forward-looking and reflect aggregate expectations from market participants about future economic developments, as well as market conditions.

What we can see from the data, however, is that periods of volatility tend to be associated with future periods of higher volatility.

The lessons from all of this are that, firstly, volatility is a normal part of a well-functioning market, particularly during periods of higher uncertainty. Secondly, volatility predicts volatility, but not returns.

That all adds to the case for investors to exercise discipline within their chosen plans, staying focused on their goals and resisting the urge to shut stable doors after horses have bolted.

—

DISCLOSURES

The information in this material is intended for the recipient’s background information and use only. It is provided in good faith and without any warranty or representation as to accuracy or completeness. Information and opinions presented in this material have been obtained or derived from sources believed by Dimensional to be reliable, and Dimensional has reasonable grounds to believe that all factual information herein is true as at the date of this material. It does not constitute investment advice, a recommendation, or an offer of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. Before acting on any information in this document, you should consider whether it is appropriate for your particular circumstances and, if appropriate, seek professional advice. It is the responsibility of any persons wishing to make a purchase to inform themselves of and observe all applicable laws and regulations. Unauthorized reproduction or transmission of this material is strictly prohibited. Dimensional accepts no responsibility for loss arising from the use of the information contained herein.

This material is not directed at any person in any jurisdiction where the availability of this material is prohibited or would subject Dimensional or its products or services to any registration, licensing, or other such legal requirements within the jurisdiction.

“Dimensional” refers to the Dimensional separate but affiliated entities generally, rather than to one particular entity. These entities are Dimensional Fund Advisors LP, Dimensional Fund Advisors Ltd., Dimensional Ireland Limited, DFA Australia Limited, Dimensional Fund Advisors Canada ULC, Dimensional Fund Advisors Pte. Ltd., Dimensional Japan Ltd., and Dimensional Hong Kong Limited. Dimensional Hong Kong Limited is licensed by the Securities and Futures Commission to conduct Type 1 (dealing in securities) regulated activities only and does not provide asset management services.

RISKS

Investments involve risks. The investment return and principal value of an investment may fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original value. Past performance is not a guarantee of future results. There is no guarantee strategies will be successful.

AUSTRALIA

This material is issued by DFA Australia Limited (AFS License No. 238093, ABN 46 065 937 671). This material is provided for information only. No account has been taken of the objectives, financial situation or needs of any particular person. Accordingly, to the extent this material constitutes general financial product advice, investors should, before acting on the advice, consider the appropriateness of the advice, having regard to the investor’s objectives, financial situation and needs. Investors should also consider the Product Disclosure Statement (PDS) and the target market determination (TMD) that have been made for each financial product either issued or distributed by DFA Australia Limited prior to acquiring or continuing to hold any investment. Go to dimensional.com/funds to access a copy of the PDS or the relevant TMD. Any opinions expressed in this material reflect our judgement at the date of publication and are subject to change.