Share market fluctuations often dominate headlines, with dramatic phrases such as “billions wiped off the market” and “biggest drop since…” sparking fear among investors. The natural reaction for many is to panic and take action—but often, the best action is to stay the course and do nothing.

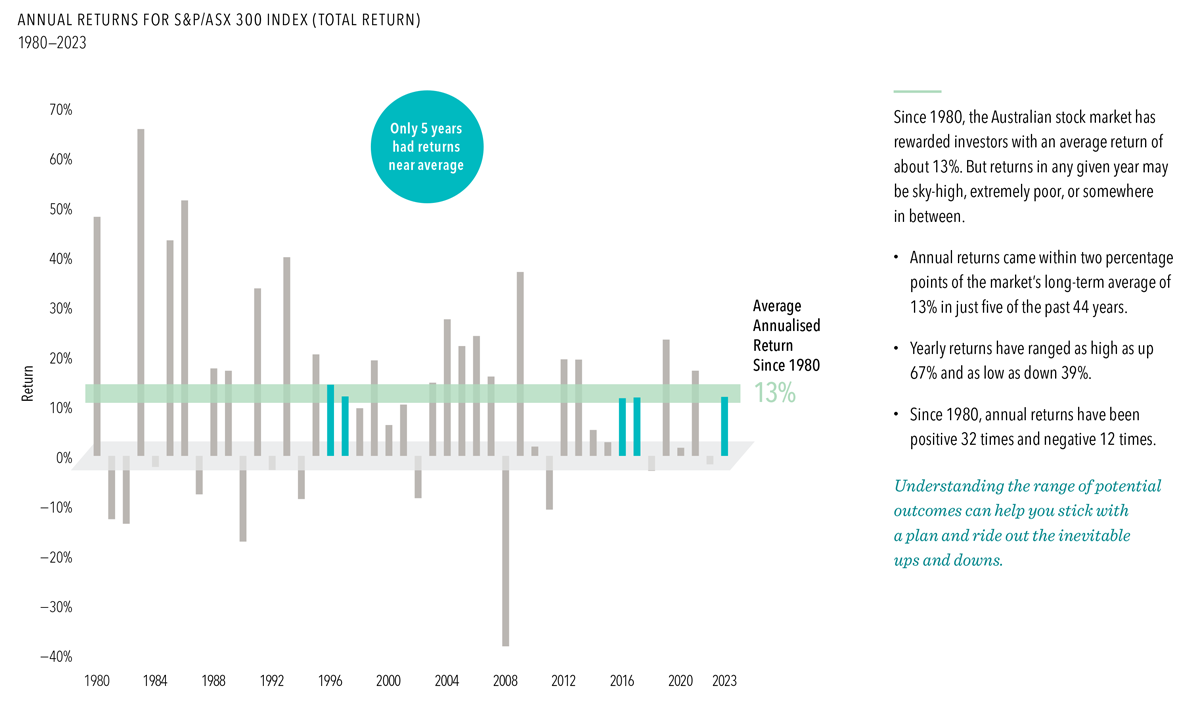

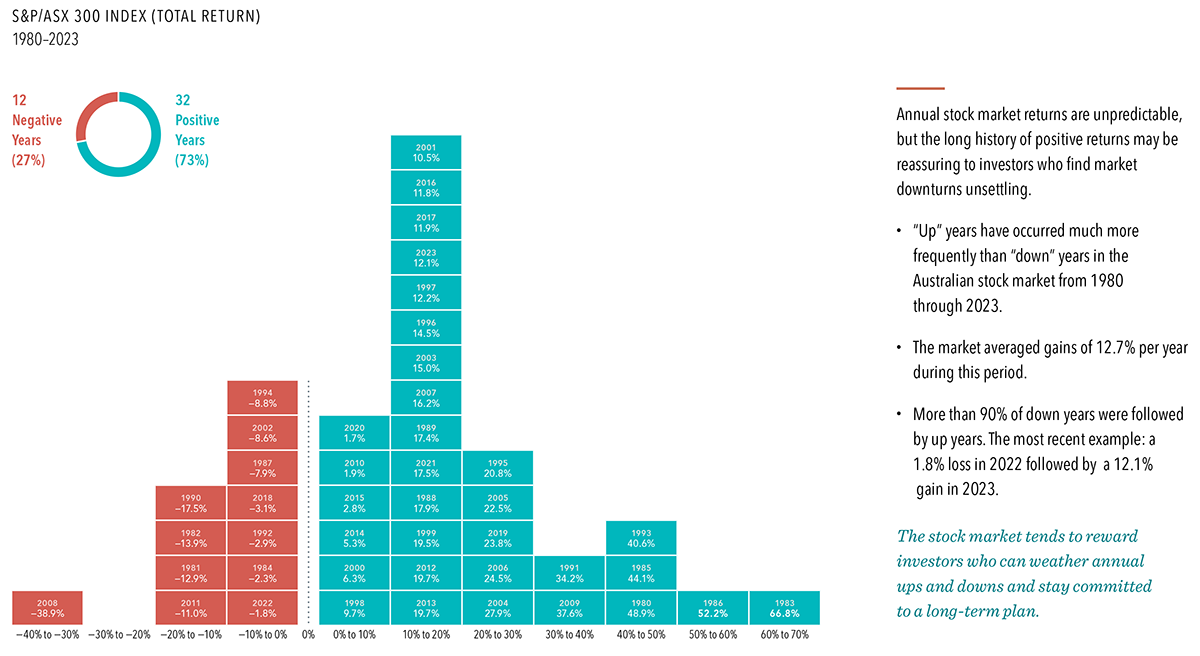

Market volatility is a normal and expected part of investing. However, history shows that those who remain invested are often the ones who benefit the most in the long run. Here’s why you should tune out the noise, stay invested, and trust your financial plan.

1. Market declines are normal and expected

Market drops can feel alarming, but they are not unusual. Corrections and bear markets happen regularly, and history shows that they are often followed by strong recoveries.

During the COVID crash in 2020, investors who stayed invested were significantly better off than those who switched to cash.

Even during the Global Financial Crisis (GFC), markets eventually rebounded, rewarding those who remained patient. If you sell during a downturn, you turn a temporary loss into a permanent one. The best way to build long-term wealth is to ride out short-term fluctuations.

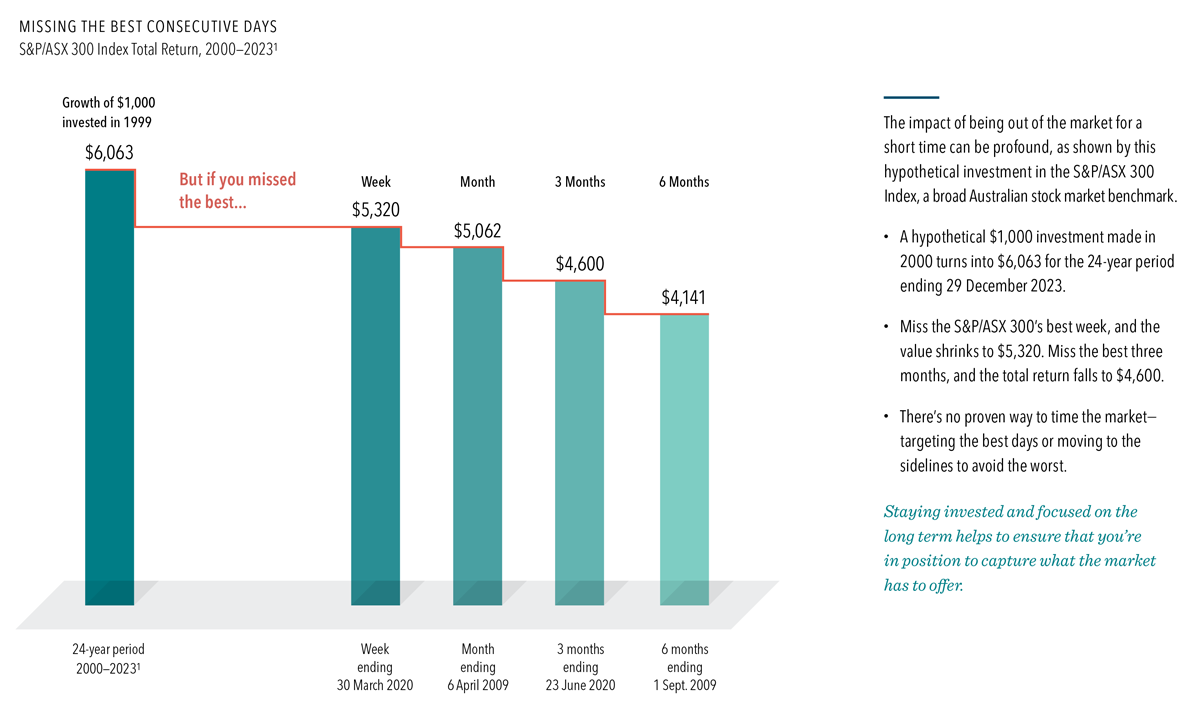

2. Timing the market is almost impossible

It may seem tempting to sell now and reinvest when things “feel safe” again, but this strategy rarely works. The biggest problem? Most people wait too long to reinvest, missing the strongest periods of market recovery.

By the time investors feel confident enough to buy back in, markets have often rebounded significantly.

This means selling low and buying high—the exact opposite of what successful investors do.

Staying invested ensures you don’t miss the best days of market growth, which often come immediately after a downturn.

3. Your financial plan already accounts for market volatility

One of the biggest behavioural biases investors face is the urge to take action during uncertain times. However, your financial plan was built with market downturns in mind.

Market volatility is factored into your investment strategy.

Unless your financial goals have changed, short-term market movements should not impact your long-term plan.

Your portfolio is designed to weather market ups and downs while aiming for long-term growth.

When you started investing, you likely considered how you would react in a downturn. If you told yourself, you would stay the course, now is the time to stick to that commitment.

4. The market rewards patience

Many of the most successful investors are those who have the patience to stay invested during turbulent times.

Even during the worst crashes, markets have always recovered over time.

Long-term investors who held through the Global Financial Crisis saw their portfolios grow significantly in the years that followed.

Those who sold during short-term market drops often locked in losses and missed the recovery. The key lesson? Investing is a long-term game, and patience is often the greatest advantage an investor can have.

5. Dividends continue even during market declines

While share prices may drop, dividend payments from many well-established companies continue to provide an income stream.

Many Australian companies continue paying dividends even when share prices fall.

The recent market downturn has not erased the gains investors made in previous months.

If you reinvest dividends, you are effectively buying more shares at a lower price—setting yourself up for stronger returns when markets recover.

This means that while your portfolio value may fluctuate, your investments continue to generate income.

6. Market drops create buying opportunities

Market declines do not just create challenges—they also create opportunities.

Falling share prices mean you can buy quality assets at a discount.

The Australian superannuation system naturally takes advantage of this by regularly investing in shares over time.

When markets recover, investments made during downturns often yield strong returns.

While it is impossible to time the bottom, continuing to invest consistently (or even increasing contributions during a downturn) is one of the best ways to build long-term wealth.

7. Tune out the noise and focus on the long term

Media headlines tend to exaggerate market volatility, making every downturn sound like the end of the financial world. However, for long-term investors, these downturns are often just a blip on the radar.

Focus on your personal financial goals, not day-to-day market movements.

Stick to your investment plan and trust the long-term process.

If in doubt, seek advice rather than reacting emotionally to market news.

One of the best things you can do for your financial future is to tune out the short-term noise and focus on your long-term objectives.

Final thoughts: Stay invested, stay confident

Market volatility can feel uncomfortable, but history shows that those who remain patient and disciplined are ultimately rewarded. The worst thing you can do is sell in fear, only to buy back in at higher prices later.

If your long-term goals have not changed, your investment strategy should not either.

As always, if you have any concerns or wish to review your financial plan, we are here to help.